Don’t you love it when irresistible reality smashes into immovable liberal fantasy? It creates a critical mass of illogical proportions that blows the mind.

On the pages of the Las Vegas Sun today is reprinted a four-day-old editorial dismissing all the Republican tax reform plans out of hand. (The paper has yet to print its online editorial questioning the state’s “most conservative newspaper” editorial about a polluting solar thermal plant.)

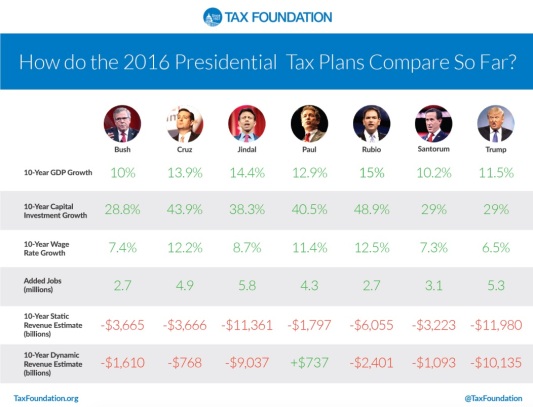

Meanwhile, in the pages of Investor’s Business Daily, there is a column about how GOP candidate Ted Cruz’s flat tax plan would create jobs and grow the economy, and the Tax Foundation has created a webpage comparing the various Republican tax plans, showing all the plans would create more jobs and grow the economy.

The Timesmen (and Timeswomen, to be politically correct) assert that the proposed “big and broad cuts” mostly benefit the wealthy — with their customary knee-jerk class envy without any inkling that the wealthy might spend that windfall on cars, yachts and other luxuries made by American workers.

“All of these candidates deny fiscal reality,” the editorialists insist, with fiscal and historic blinders firmly in place. “In the next 10 years, revenues will need to increase by 40 percent simply to keep federal spending even, per capita, with inflation and population growth. Additional revenues will be needed to pay for health care for the elderly, transportation systems and other obligations, as well as for newer challenges, including climate change. And interest on the national debt will surely rise because interest rates have nowhere to go but up.” They conclude taxes have to go up. It is inevitable. It is dogma. It is in stone.

To begin, why must revenues increase? Can spending never be cut? Secondly, they ignore the concept of elasticity and dynamism. Letting people keep and spend their own money can and does grow the economy and has done so in the past.

The IBD columnists point out that working people currently bear 80 percent of the tax burden in the form of reduced wages that would otherwise be paid. Of Cruz’s plan, the writers note, “The Tax Foundation scores the 16% business flat tax as raising $25.4 trillion in federal revenues over the next decade, which would account for 71% of all federal revenue.”

Meanwhile, the Tax Foundation shows every GOP presidential candidate tax plans so far announced would increase GDP by more than 10 percent, wages by at least 6.5 percent, jobs by 2.7 million to 5.8 million, and only slightly reduce federal revenue — except Rand Paul’s plan, which would actually grow tax revenue.

Find online at Tax Foundation.

And where are the plans from the Democratic candidates? What is their plan to grow our stagnant economy and increase wages? Giving away free stuff won’t cut it.

The Tax Foundation did not score the revenue that would be gained by repatriation of money corporations are now holding overseas. Nor did it score the impact of the $25,000 savings accounts proposed by Senator Cruz. No one knows for sure how much money is overseas and how much would be brought back to the U.S. It is estimated to be in the tens, if not hundreds of millions.

Of course, it will depend on the American people to pressure Congress to enact any plan which simplifies the tax code and thereby takes away from the power of the Washington Cartel.

The republican tax plans are aimed exclusively at making the rich richer. And, perhaps a congratulations is due because, that plan has worked since Reagan slashed taxes on the wealthiest beginning in the early ’80s.

Stockman told him then that his plan wouldn’t work to increase government revenues, but that didn’t matter because that was never the point, in fact it was exactly the opposite; republicans don’t even hide the fact that they WANT “smaller government” so all their blather about “increasing government revenues” as some weird happenstance of cutting tax rates for the richest is directly contradicted by their own policy.

The fact is, the republicans WANT. A government “they can drown in a bathtub” and that means chocking off the money, all the while funneling it to the richest of the rich.

And, as a special added bonus, and a very heinous twist to it; while they are starving the government for revenue, they are blaming it for failing to do the things it can’t do because it doesn’t have the money to do them.

And their sheep bleat in approval.

“…without any inkling that the wealthy might spend that windfall on cars, yachts and other luxuries made by American workers.” Sounds a lot like trickle down economics all over again. 50 years of stagnant wages and soaring profits for the rich roundly disproved the whole concept – unless the concept is to perpetuate the wealth of the rich, which it did quite well. I have a better idea. We’ll call it trickle up economics. Tax the snot out of the wealthy and get it into the hands of the middle class – perhaps by making their income tax zero as we have done for so many rich folk. We’ll call that a “jump start for greater profits”. The middle class will surely spend the money on products and services from businesses owned by the wealthy. A rising tide lifts all boats, you know. I’m sure the rich would benefit at least as much as the middle class did from trickle down.

Patrick you demonstrate daily that Reagan was correct when he stated that liberals know so much that just isn’t so.

Look it up – Tax revenue pouring into the Treasury did indeed increase under Reagan. The Republican controlled Congress just passed a very hefty budget increase that fails to close even one government program and pretty much gives Obama authority to raise the debt ceiling to whatever he wants. Not quite the government you can “drown in a bathtub”. Any pretense that Republicans want smaller government has surely been exposed for a lie. The Grand Ole Party leadership has joined with Democrats in a truly bipartisan budget busting bill.

Time for liberals to stop blaming the Republicans for trying to shrink government. Who are you going to blame now when wages continue to stagnate, jobs disappear, and the poor get poorer?

Apparently the only argument liberals have in defense of Democrat economic illiteracy is: Republicans were bad, too.

Pretty much! (We’re still waiting for a definitive alternate tax plan from our resident lefties…one that specifically defines what their definition is of the “fair share” the one percent should pay).

Barbara you demonstrate daily that, for conservatives, if it don’t fit on a number sticker, they can’t understand it.

Government revenues, as a percentage of GDP FELL after Reagan slashed to marginal rates from 70% to 50%, BUT, revenues INCREASED, as a percentage of GDP, after Reagan INCREASED taxes.

And again, conservatives have for years, told the American public that they want smaller government, and some have been very descriptive about exactly how small they want it; small enough to drown in a bathtub.

Pretending therefore, that somehow their flat tax, or other grossly inappropriate tax ideas designed to favor the wealthiest might actually provide more money to the government is anathema to their professed idea to drown the government and can ONLY be an effort to mislead the American public that otherwise would reject their nonsense. As it has for more than 100 years.

And HFB, I have repeated EXACTLY how much the rich ought to pay, and it’s the same amount that Reagan thought was appropriate when he agreed to that rate.

But, maybe you just missed it, so here it is again.

Here’s a nice analysis of exactly what happened when Reagan did his thing.

https://www.washingtonpost.com/news/fact-checker/wp/2015/04/10/rand-pauls-claim-that-reagans-tax-cuts-produced-more-revenue-and-tens-of-millions-of-jobs/

A nice quote from a Cato Institute analyst in the above article:

“Moore directed us to a paper he co-wrote in 1996 while at the Cato Institute, which offered a defense of the Reagan economic record. As we said, that’s for economic historians to sort out. But the paper says it was “an enduring myth” that Reagan officials believed tax cuts would pay for themselves. “This was nonsense from day one, because the credible evidence overwhelmingly indicates that revenue feedbacks from tax cuts is 35 cents per dollar, at most,” the paper says, noting that “the Reagan administration never assumed that the tax cuts would pay for themselves.”

The “conservatives” had ZERO intention that the government get more money, and KNEW that the tax cuts would merely funnel more money to the rich, but it sure didn’t stop them from lying about it, as they are doing now.

Patrick – either you did not read the Cato analyst in full or you intentionally misrepresented what he said. His last paragraphs:

Measured in 2009 dollars, real federal revenues rose from $1.37 billion in 1981 to $1.64 billion by 1990 – a 21.3% gain. President Reagan left office in January 1989 but his tax rates lasted another year. Top tax rates were then increased in 1991 and 1993, but real federal revenues in 1993 were no higher than in 1990 when the top tax rate was 28%. As a share of GDP, revenues were 17.8% in 1989 but remained well below that level until 1995. Revenues again reached 17.9% of GDP in 2007 (despite some revenue-losing 2001-03 tax breaks), but only14.9% from 2009 to 2012.

The usual cheerleaders for Carter-era tax rates jumped on Twitter with shouts of “Voodoo!” and “Smoke and Mirrors” when Washington Post writer Glenn Kessler awarded Rand Paul Three Pinnochios for telling the truth about tax revenues rising from 1981 to 1990. It is Mr. Kessler who deserves Three Pinnochios.

The full article debunks the “fact-checker” Mr. Kessler and you really should read it to understand how the liberal media twists reality. What can not be distorted is the overwhelming support Reagan had among both Democrats and Republicans. Here is an article from your beloved NY Times detailing his landslide historic victory:

His economic policies raised the income levels of all people and greatly benefited minorities and the working class.

“Apparently the only argument liberals have in defense of Democrat economic illiteracy is: Republicans were bad, too.” Not bad, worse. Democrats are imperfect; Republicans are about half crazy. You can call that defending Democrats if you like. We may appear to defend Democrats only in reaction to the extreme, one sided criticism of them while Republicans are given a free pass.

And just because I don’t agree with the extreme Conservative position doesn’t mean I subscribe to Democratic thought. An example would be global warming. My consistent position does not agree with that of most Democrats. I say that no one can predict the future, but that global warming represents a serious risk to our well being. Your position however, is in perfect lock step with the Republican Party platform.

An example of Democrat stupidity: The Obama Administration gave money to the banks and ignored the fate of those having their homes foreclosed, when helping the homeowners would have also helped the banks and probably would have cost less too. He was too anxious to leave Afghanistan and Iraq as well. Happy? Now, let’s see if any of you Conservatives can say anything negative about Republicans, except for Winston, who has shown that he is not a Republican shill. Come on, you can do it.

Barbara I didn’t “misrepresent” anything Moore said, I merely quoted it. And as far as understanding what he said, I think this is a case of you being “the pot”. In other words, you didn’t understand what you read which was that the Reagan administration never thought, or even intended, that their tax cuts would increase revenue for the government. Furthermore, as the Treasury Departments analysis showed, tax revenues FELL after the tax cuts were enacted, but ROSE after tax increases were imposed by the administration. History, and Reagan’s own Budget Office conceded that revenues fell, and would never rise to meet the government revenue shortfall, and this, Reagan and Congress, INCREASE taxes (more than under any president) and only THEN did revenues increase.

This information is all contained within the article I cited.

But, let me quote from the article about the Treasury Departments analysis so people don’t have to look to hard:

“But we can get even more specific about the impact of the 1981 cut in rates. A Treasury Department study on the impact of tax bills since 1940, first released in 2006 and later updated, found that the 1981 tax cut reduced revenues by $208 billion in its first four years. (These figures are rendered in constant 2012 dollars.)”

So Patrick wants to lower the top tax rate to 28%…(according to his definition). That’s gotta make Reagan smile.

Good thing st. Ronnie raised tax rates several times

Congress did raise various taxes and fees which Reagan signed. The agreement in 1982 was $3 of spending cuts for every $1 of tax increase. He later lamented that all he ever got were the taxes. “Congress never cut spending by even one penny, ” Reagan complained in 1993.

Ditto for amnesty and Congress’ promise to secure the border.

“Included in the act was an across-the-board decrease in the marginal income tax rates in the United States by 23% over three years, with the top rate falling from 70% to 50% and the bottom rate dropping from 14% to 11%. This act slashed estate taxes and trimmed taxes paid by business corporations by $150 billion over a five-year period. Additionally the tax rates were indexed for inflation, though the indexing was delayed until 1985.”

https://en.wikipedia.org/wiki/Economic_Recovery_Tax_Act_of_1981

Yes HFB, this rate ought to make Reagan smile, as it did when he agreed to it, and cheered when it passed.

Doesn’t the president have the power to veto spending bills?

All this nonsense about what Reagan “thought” is absurd; his advisors told him what was happening, and he signed the bills with that knowledge. Whatever happened to “personal responsibility” anyway?

With all of his rhetoric, Reagan decided to trust Congress? Seems unlikely. Much easier to get the economic benefits of increased government spending and then claim that it wasn’t his fault. Politics 101.