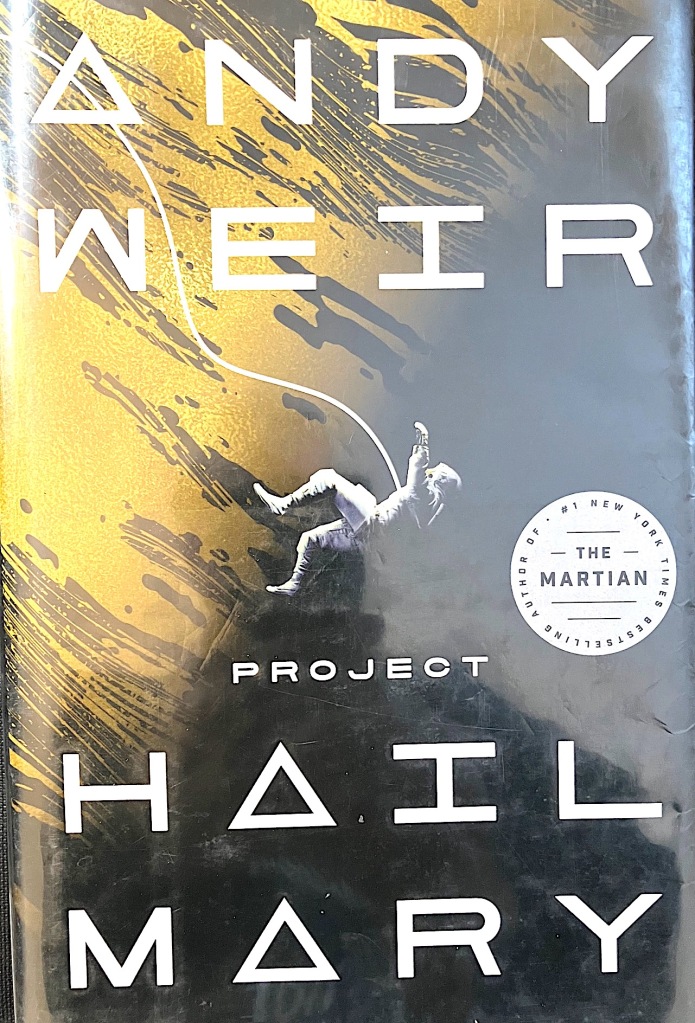

I’ve read all the best. Science fiction authors that is: Heinlein, Clarke, Asimov, Bradbury, Wells, Dick, Herbert, Le Guin, Card and many more.

But Andy Weir’s “Project Hail Mary” is unique. It delves deeply into math, biology, imperial to metric conversion, physics and even quantum physics. It’s problem-solving protagonist Dr. Ryland Grace is detailed in his analysis and complex in his character. Dismissed as misguided by academics for an essay suggesting life can exist without water, Grace turns to teaching middle school science.

When the sun inexplicably begins to lose energy, Grace is one of the many scientists recruited to discover why. He finds in a sample of space debris a microorganism that he dubs Astrophage that “eats” Sol’s energy and then migrates to Venus to breed in its carbon dioxide-rich atmosphere.

Researchers also find the solar system’s sun is not the only one dimming in the region, but is one of many, with a single exception — Tau Ceti, a system light years away.

Thus begins the Hail Mary project — a mission to find out why Tau Ceti is the exception. Ironically, the energy digestion system of Astrophage makes it the best possible propulsion system for the starship mission to Tau Ceti. This introduces new problems later for Dr. Grace to solve if he is to survive.

The book’s narrative switches seemingly randomly between Grace preparing for the outer space mission to actually being aboard, but the plot is built piece by piece. Problem discovered, problem painstakingly solved.

Weir can also be a bit of a tease. At one point, Grace encounters an alien also in search of a solution to the star-ingesting epidemic. Due to the alien’s appearance, Grace calls him Rocky. Meanwhile, Rocky has given a name to one of Tau Ceti’s planets, calling it the same name as his reproductive partner back home. Grace calls the planet Adrian, without bothering to explain to the reader that Adrian was the name of the wife of the fictional movie character Rocky.

Will earth survive? Will Grace survive? Let’s just say the ending comes full circle and is fully worth the 476-page trek.